Where inflation goes, interest rates will follow, and asset markets will recover.

24 April 2024 / 8 min readKiwibank chief economist, Jarrod Kerr, provides the latest insights on the economic environment.

- The RBNZ have orchestrated a recession. Higher rates have hurt Kiwi households and businesses. And asset markets have been dragged down. But if inflation drops back to target, this year, interest rates will fall.

- We believe the RBNZ will be in a position to start cutting from November. Financial market traders are betting on more, a lot more, near term. We should all be right on direction, it’s the timing that’s difficult.

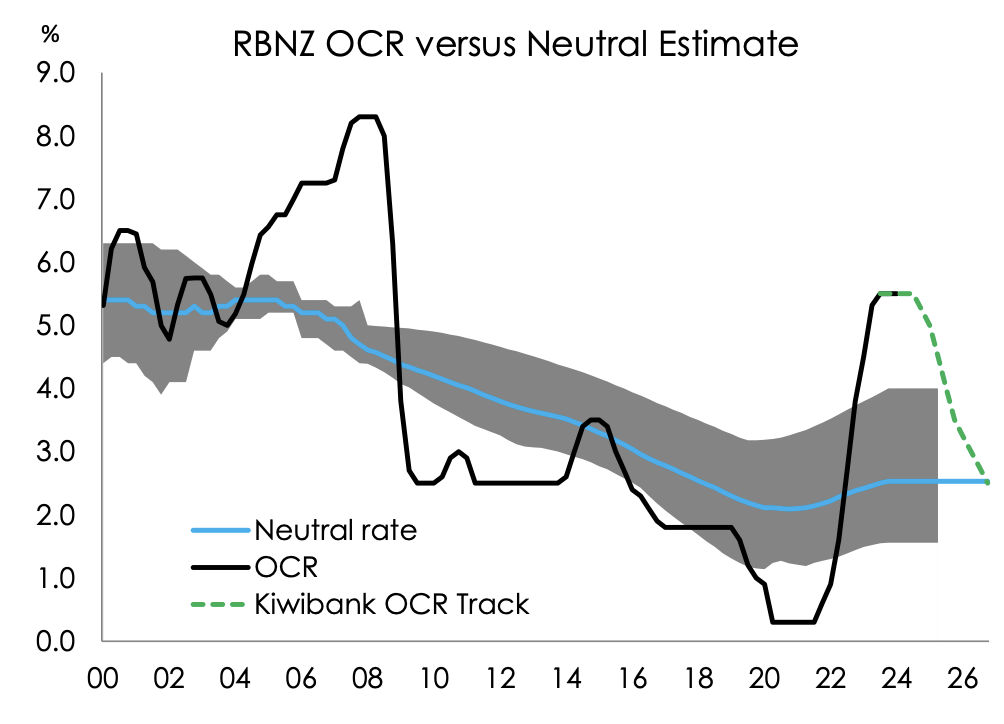

- What’s key for property markets, both commercial and residential, is the magnitude of possible rate cuts. If the RBNZ returns the cash rate to a ‘neutral’ setting, around 2.5-to-3%, that’s at least 250bps of cuts.

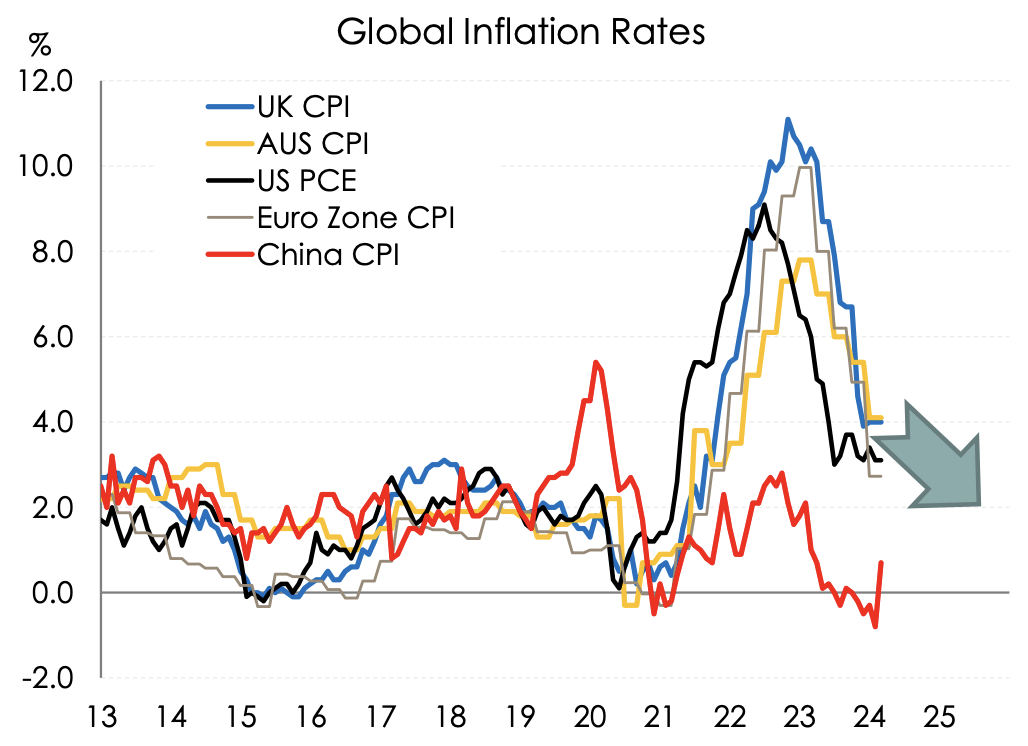

Most central banks have faced the same problem, rapid inflation coming out of Covid. And most central banks responded by hiking interest rates to levels that deliberately hurt, to rein in heated economies and asset markets. We’ve taken our medicine. Getting inflation back to 2% is seen as the optimal run rate. We have seen the heat come out of goods markets and asset markets, like property. But we need to see a little more heat come out of labour markets, and services. Will they get inflation back to 2%? We think so. And when they get there, they can unwind restrictive policy, returning to more neutral settings. Rate cuts will be well received and support asset markets, like property.

We forecast substantial declines in interest rates this year and next. The great unwind of heavy handed hikes will help households and hampered businesses, producing a better outlook. The glass half empty will turn full. 2024 will be a better year than 2023, and 2025 will be better than 2024.

Inflation fighters we are.

It’s all about inflation and the outlook for central banks. They are inflation fighters through and through. So, at what point will we see a claim of victory? Well, soon. Central banks are growing in confidence.

“We are waiting to become more confident that inflation is moving sustainably to 2%. When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession”

Fed Chair J. Powell

“We are making good progress towards our inflation target and we are more confident as a result – but we are not sufficiently confident”

ECB President Christine Lagarde

And in a surprise move, the Swiss National Bank was the first to start cutting on 21st March. They’re forever trying to weaken their currency, and have confidence inflation has been tamed. Other central banks will follow.

Global growth and inflation can be beautifully correlated. So too, are the actions of policymakers. Most in the market follow the Fed, and reflect back to their local central bank. And many central banks, the RBNZ included, will want the Fed to act as icebreaker. If the Fed leads, then the Kiwi currency should hold up against the greenback, helping to ease imported inflation. We need that sort of help.

Inflation is wilting.

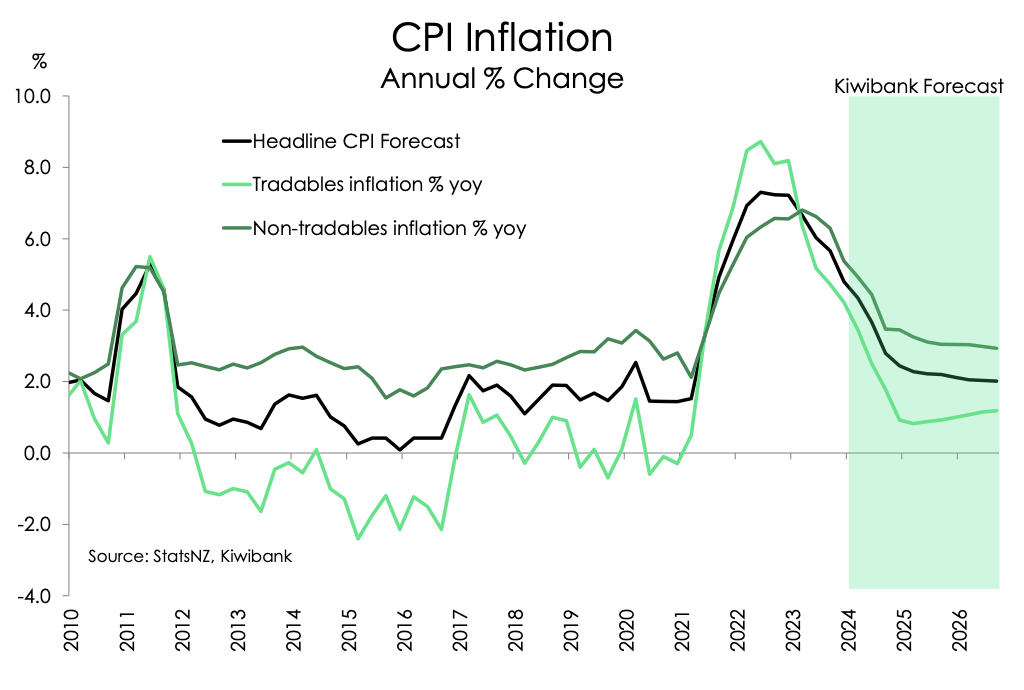

A big part of the disinflationary story stems from offshore. Tradables, or imported, inflation has fallen from a lofty peak of 8.7% in June 2022, to 1.6%, and we forecast a further fall to well under 1% next year. It’s the decline in global inflation rates, especially those in China, that have us gaining confidence.

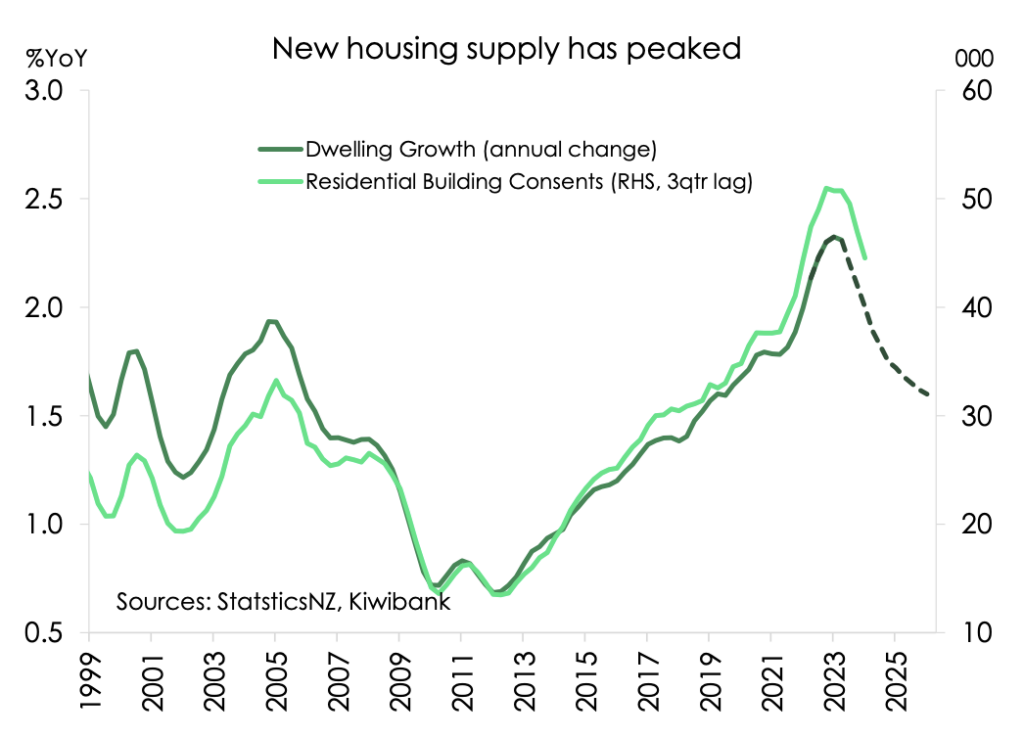

The complication is in domestically generated inflation. Non-tradable inflation is sticky at 5.8%, down from 6.8%. And the migration boom is having a push-pull effect. More workers, means reduced wage pressure. That helps. But more people also means more strain on creaky infrastructure and more demand for just about everything. Most notably, there has been the lift in rent growth. Residential rental inflation has risen to 4.7%, high above the circa-3% pre-covid rates. A shortage of housing is to blame. The migration boom is inflating the economy, and will boost demand in all markets, including commercial property.

Ultimately, we forecast inflation falling below 3% this year, and we expect headline to push toward 2% next year. That’s key to any property market outlook. Effectively, our forecast path for inflation, is a forecast path for policy.

Cuts are over and underpriced.

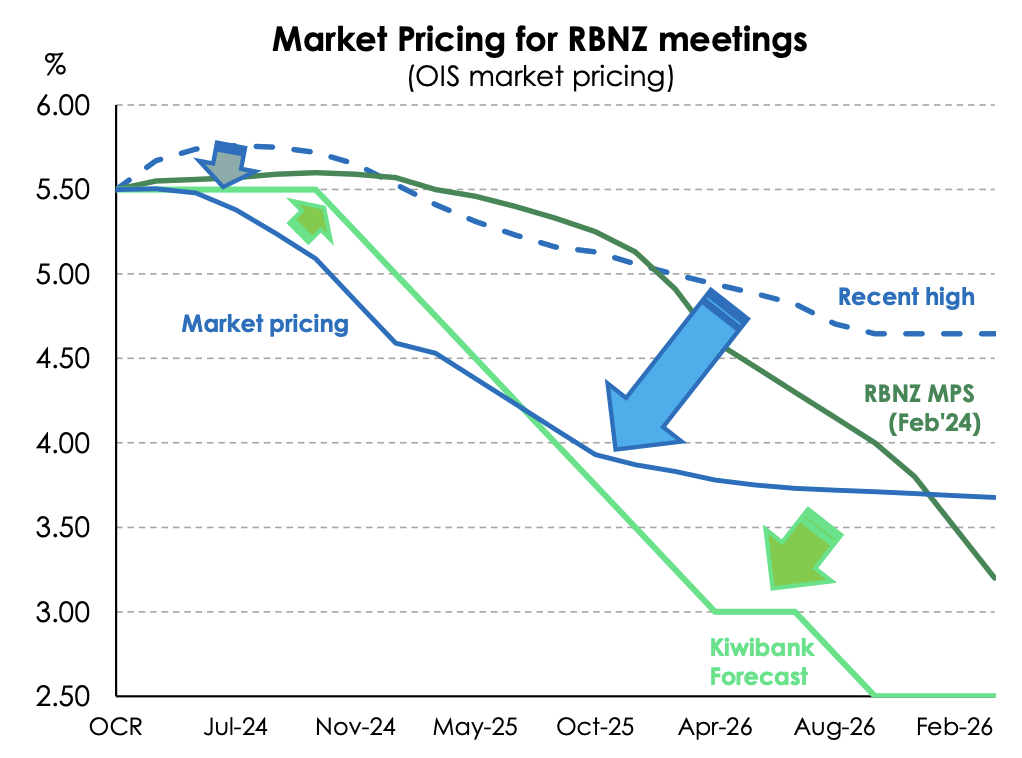

The RBNZ’s decision in February to keep the cash rate unchanged at 5.5%, despite calls from some commentators for hikes, has seen market pricing reverse. Bets on rate hikes have swung to rate cuts. It has been a significant change in psycology. Dire pessimism is turning into optimism.

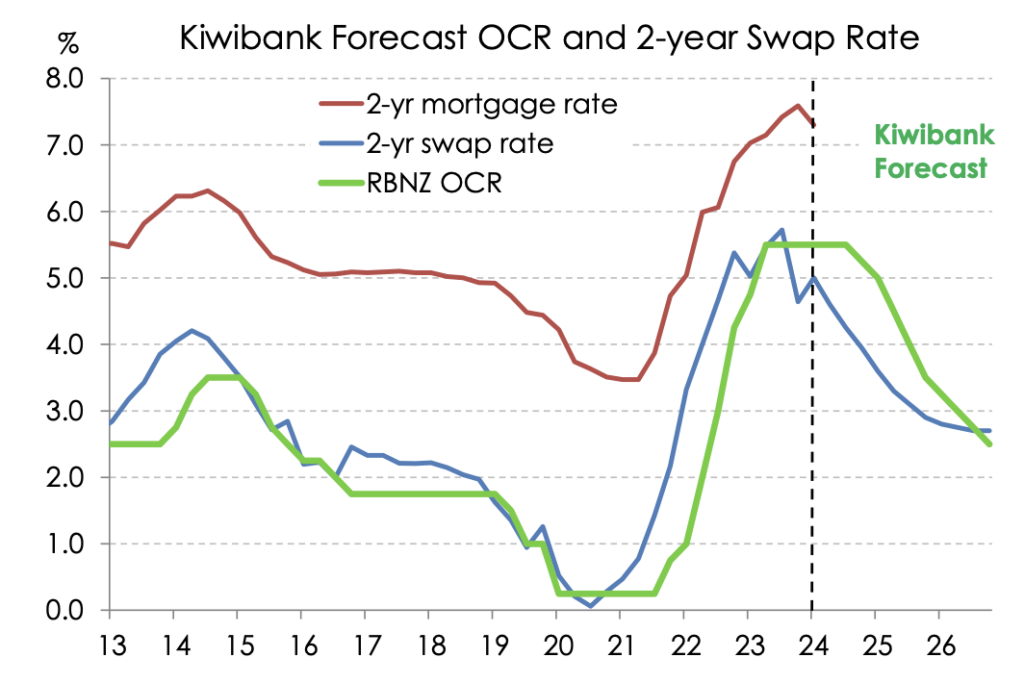

The chart to the right plots the RBNZ’s OCR track, Kiwibank forecasts, and current market pricing. We, along with the market, are miles ahead of the RBNZ. That’s not unusual. Markets turn much faster than central banks. And market pricing has moved from sitting close to RBNZ estimates, to below our estimates near term (blue arrow).

The cuts priced into July and August may prove a little optimistic, and are likely to be pushed back. It’s further out where pricing becomes a little light. We forecast 25bp cuts in each meeting from November, until we get back towards neutral – around 2.5-to-3%.

If we’re right, then the interest rate curve should move as follows. We forecast the pivotal 2-year swap rate to break back below 5% in the next quarter. And then we expect the 2-year to ease down to 4.0% by year-end. Over 2025, as the RBNZ cuts below 4%, the 2-year will fall towards 3.0%. So we could see a fall in interest rates of around 250bps. Such a move should see similar falls in mortgage and business lending rates, but also term deposit rates. Good news for many, bad news for some. The lowering of interest rates will provide much needed relief for indebted households and businesses. And it is the expectation of these rate cuts that has us in the more “optimistic” camp when thinking about economic growth, household wellbeing, business expansion, and the recovery of the property market – both commercial and residential.

The chart above highlights how restrictive the cash rate is. The heavy-handed hikes into a heated housing market have halted household spending habits. And it hurts. Business lost confidence and investment intentions were deeply negative, until recently. Once the RBNZ starts to cut the cash rate, it’s not just a 25bp decision. It’s a decision to return the cash rate to a more neutral setting. And we think that’s a decision to head back to 3%, probably 2.5%.

The fall in wholesale rates has enabled banks to lower lending rates, without an actual cut to the cash rate. Expectations of hikes, turned to cuts, quite rapidly. And these lower wholesale rates, which should continue to fall into 2025 and beyond, will enable further cuts to carded mortgage and business lending rates.

Asset markets are responding to lower interest rates.

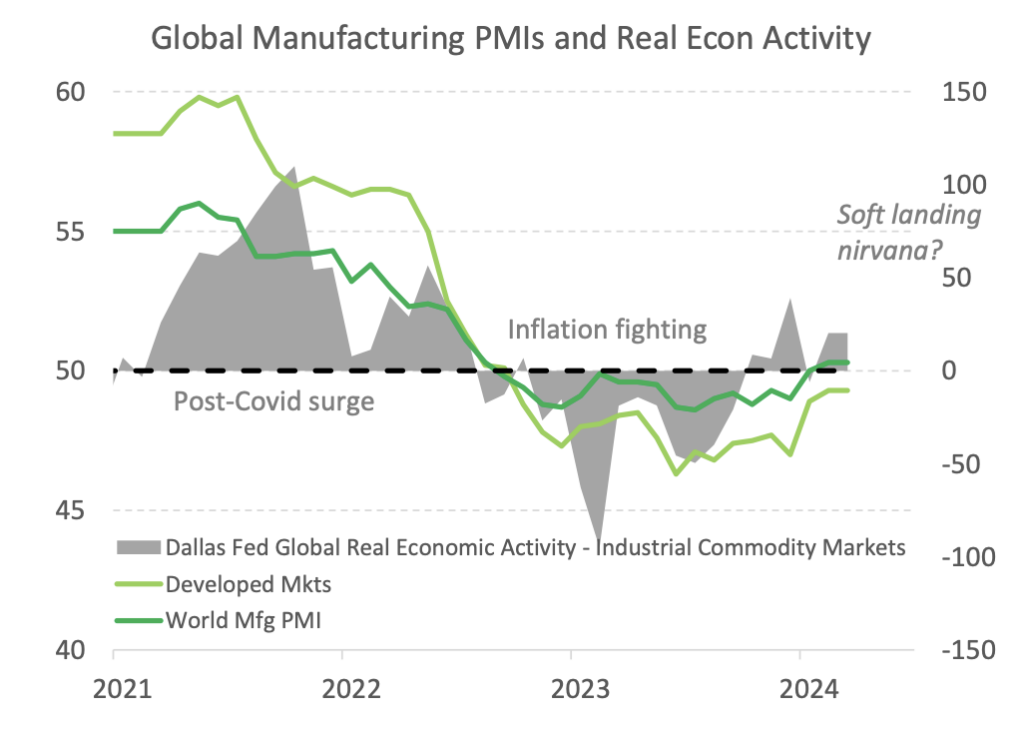

There are positive signs offshore that asset markets are likely to end the year higher, and perform well over 2025. Asset markets like growth. And leading indicators of economic growth have turned positive. Global PMIs are lifting out of the red and into the black. And that uplift bodes well for investor sentiment.

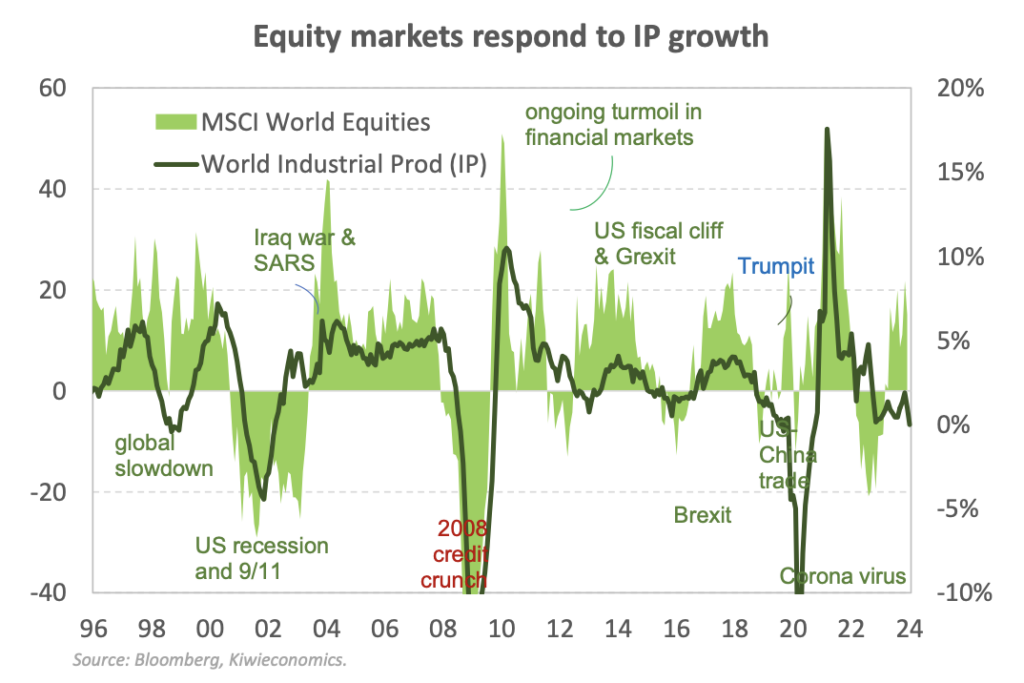

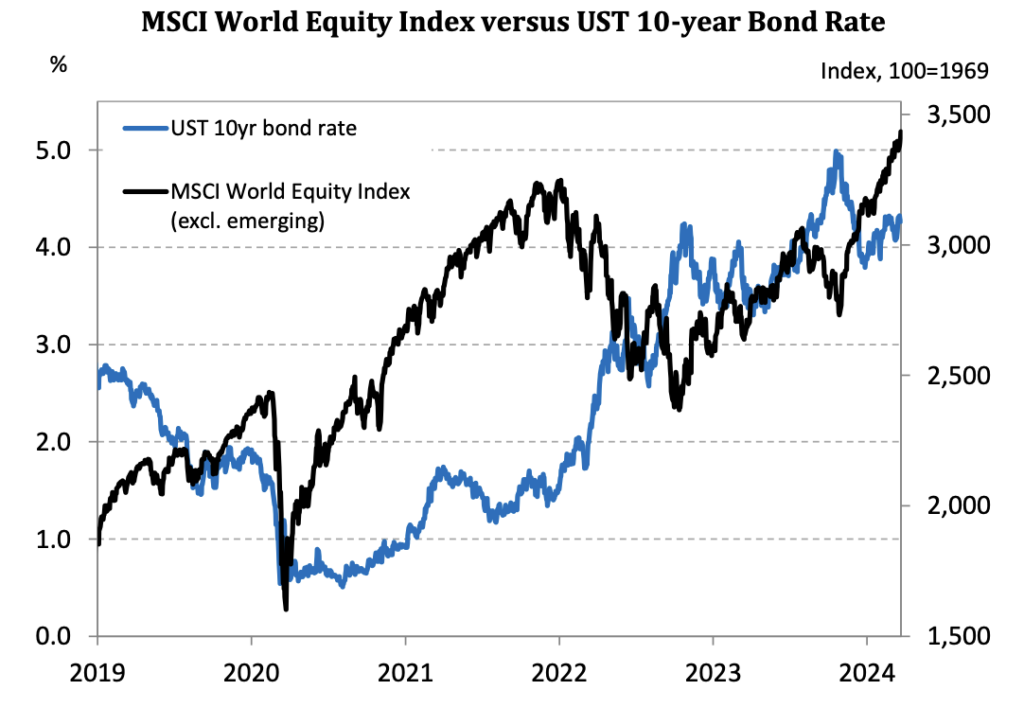

Global equity markets have responded to interest rate moves. In 2020, Covid caused a panic, and stocks plunged. Shrewd investors waited for central banks to step in. And central banks stepped in in a way like never before. Interest rates were slashed as central banks printed trillions of dollars to reflate markets. Central bank (over)action saw investors pile in, and we saw a massive bull run in most asset markets

Inflation was reborn. And central bank came in to mop up their excesses. The rapid rise in interest rates has suffocated some markets. And shrewd investors are again waiting for central banks to cut interest rates again. And they will, again. The fall in wholesale interest rates, and some retail lending already, has bolstered confidence. Rate cuts this year will pull in the shrewd investors, currently side-lined.

Back into property.

Asset markets are showing signs of recovery. Thoughts of rate hikes, shifting to rate cuts, have enticed investors back in. Anecdotes from our lenders suggest the change in Government has had a positive impact on investor sentiment. Confidence is improving. We expect to see an uplift in activity over the year ahead.

There are three drivers of commercial and residential property markets. Firstly, the outlook for interest rates, with lending rates already falling, will support confidence and activity. Secondly, the demand/supply imbalance will improve. The surge in migration and the loss of some property at high risk in climate change will only exacerbate the shortage in some areas. And finally, construction has cooled. The number of investments coming to market has fallen back from very high levels. The growth in demand, with a migration boom, will once again outstrip supply in coming years. All three drivers point to a strengthening market, and price gains.

All content is for information only, is subject to change and is not a substitute for commercial judgement or professional advice, which should be sought prior to entering any transaction. To the extent permitted by law Kiwibank disclaims liability or responsibility to any person for any direct or indirect loss or damage that may result from any act or omission by any person in relation to the material.