Investing

made easy.

Experience the benefits of investment in quality commercial real estate assets.

Accessibility

We make commercial property investment accessible to everyone.

With Oyster, you have the opportunity to own a stake in quality commercial properties without the complexities associated with buying and managing the assets yourself.

Strategic Management

We take a hands-on approach.

Our experienced team oversees the strategic management of all Oyster assets, from sourcing quality properties and structuring funds right through to property management. We manage and maintain each property in our portfolio to provide investors with a hassle-free investment experience.

Depth of Experience

We have a track record of delivering great returns.

Our depth of experience of the commercial property sector provides us with real-time market knowledge and insights. This allows us to make better, quicker, more informed decisions about how to protect and grow your investments.

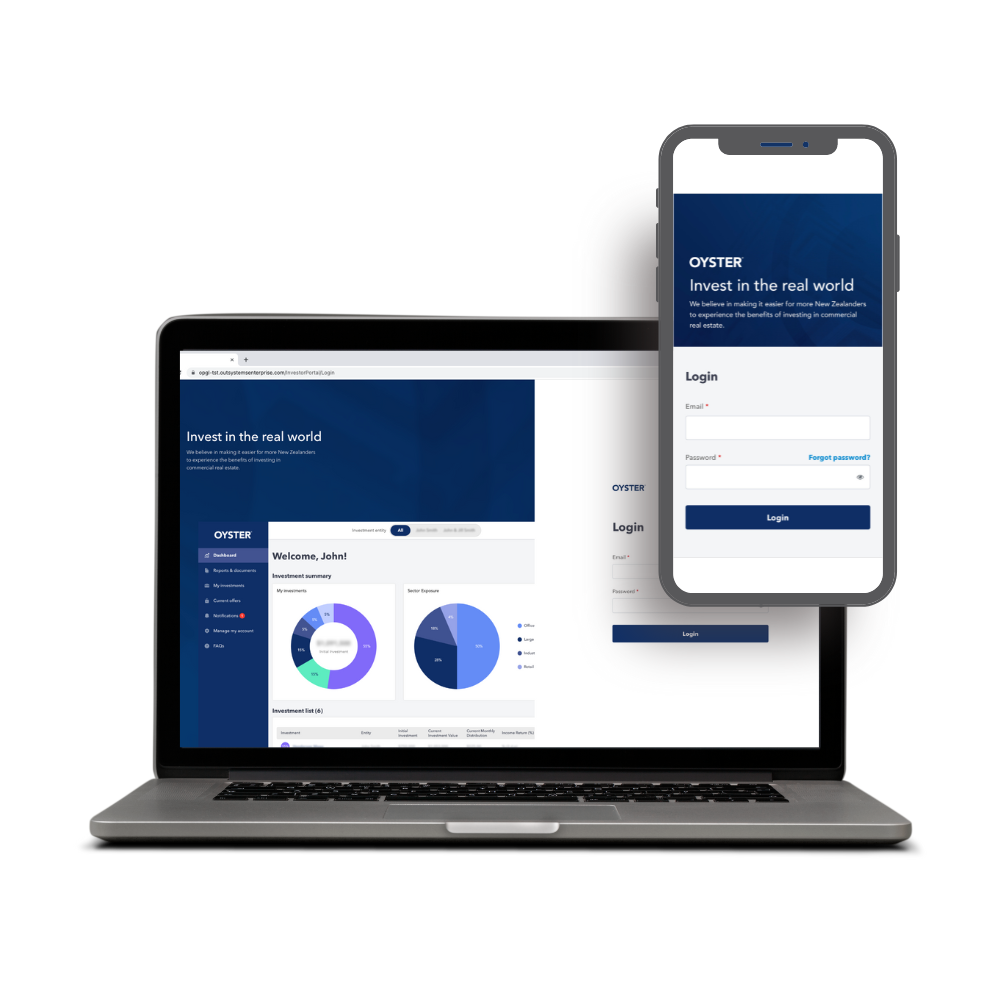

Oyster Investor Portal

The Oyster Investor Portal provides quick, easy and secure access to your investment details at your fingertips. Access:

- Personalised snapshot of how your investments are performing

- Key documents including quarterly investor updates and distribution statements

- Key upcoming dates such as annual general meetings

- Current investment offers

- Your investment details and make updates as necessary.

To learn more about the portal, watch the Portal Overview Video.

If you need to set up your access to the portal, email us here.

Meet the investor team