Twenty years of proven performance

25 July 2023 / 3 min readCommercial property is a long-term investment and can play a significant role in a diversified portfolio. Appealing due to its ability to provide regular income returns and the potential for capital gains, commercial property, like other investments, has been impacted in the current economic environment. Our ultimate focus is the delivery of optimal long-term returns and we have a proven track record of delivering this over the last two decades.

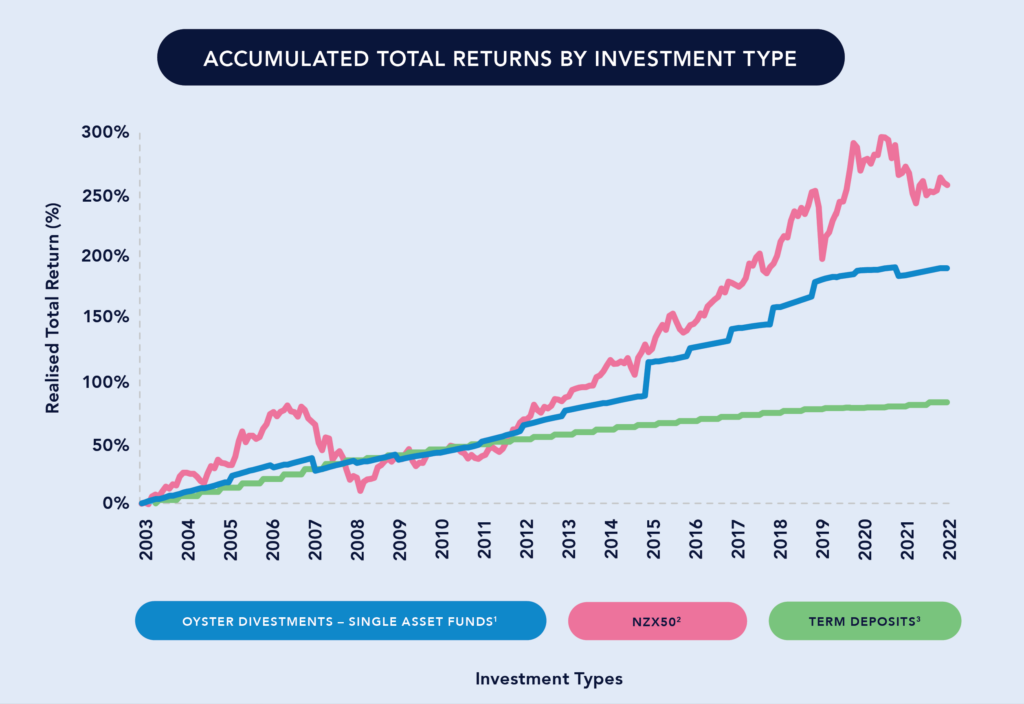

The data in the below graph measures the realised total returns of 12 exited single asset funds (due to the divestment of underlying commercial property) that were held in the Oyster portfolio since 2003, against the realised total return of investment in the NZX502 (including dividend payments) and the realised total return for 6-month term deposits3 (and subsequent principal reinvestment), on a dollar-for-dollar basis.

As the data shows, Oyster investments during the twenty-year period outperformed cash term deposits over the long term by more than two-fold.

While listed investments have delivered a higher aggregated total return, they are often more sensitive to economic factors due to sentiment driven pricing, meaning the timing of realising an investment can severely impact total returns. This is illustrated by the global financial crisis (mid 2007 to 2009) and the start of the Covid-19 pandemic (2020).

We buy quality properties in asset classes with robust long-term outlooks.

This is supported by our ability to manage the entire property lifecycle in-house, from transactions and real-time fund management to hands-on asset and facilities management, providing us with enhanced capabilities to actively manage risks and opportunities as they present themselves.

Since Oyster’s inception, we have navigated many property and economic cycles. Our learnings across the last two decades, particularly during times of volatility, inform the strategy we are applying today as we manage the pressure caused by the current economic environment.

Delivering optimal total returns for investors continues to remain our key focus.

The data speaks for itself. We are proud of the returns that Oyster has delivered to investors over the last two decades, and the way in which commercial property continues to be resilient, in the long term, throughout economic cycles.

1 The realised total returns (realised income return plus realised capital return) represents a simulated total return to a hypothetical investor who purchased each of Oyster’s single asset funds that were unwound through the sale of the underlying commercial properties (earliest fund inception in 2003) with an even weighting across the funds.

2 The realised total return for the SmartShares NZ Top 50 ETF (FNZ). Source: www.smartshares.co.nz

3 The realised total return for new interest-bearing 6-month term deposits. Source: www.rbnz.govt.nz

All income returns are not compounded, and all returns are before tax.

Past performance is no indication or guarantee of future performance. All investors are recommended to seek professional advice from a financial advice provider which considers their personal circumstances before making an investment decision.