The RBNZ overdelivers in a bid to keep interest rates higher for longer.

18 April 2023 / 7 min readKiwibank economists, Jarrod Kerr and Mary Jo Vergara, provide an update on the New Zealand economic context, and the Reserve Bank of New Zealand’s response.

- The RBNZ delivered an outsized hike of 50bps earlier this month, a step above the 25bp expected by the market and consensus of economists. And it was all to do with wholesale rates. They had fallen too far for the RBNZ.

- The RBNZ is determined to lower inflation, whatever the cost. And this month’s supersized hike reflected the RBNZ’s resolve. Demand, they say, continues to outstrip supply, causing inflation.

- The fall in wholesale rates, following weaker domestic data and concerning developments offshore, was working against the RBNZ’s desired path for policy.

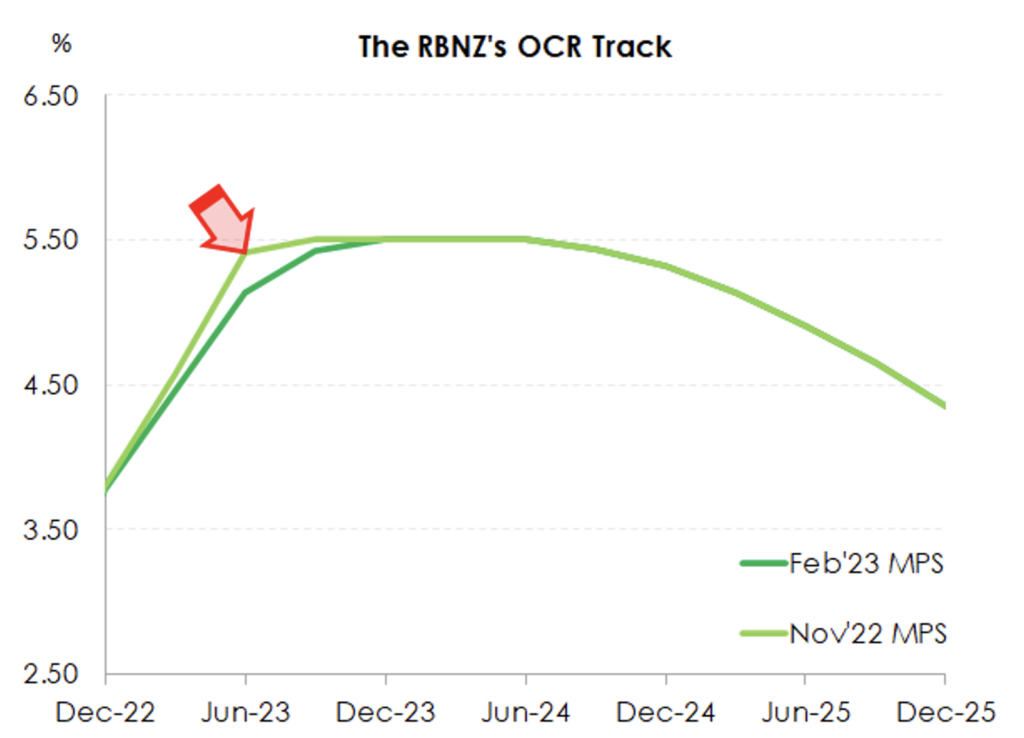

- The RBNZ is delivering on its ‘pre-set’ path first outlined in November. They want to put the cash rate at 5.5%. We must expect a 25bp move to 5.5% in May.

The RBNZ has stuck to its pre-set course, highlighted in our first chart. Weaker economic data, softer inflation expectations, and failing banks offshore were not enough to dissuade RBNZ officials. If anything, the fall in wholesale interest rates reinforced the RBNZ’s desire to deliver big. The RBNZ delivered an outsized hike of 50bps today, a step above the 25bp expected by the market and consensus of economists. And it was all to do with wholesale rates. They had fallen too far for the RBNZ. The fall in wholesale rates, following weaker domestic data and concerning developments offshore, was working against the RBNZ’s desired path for policy. And that pre-set path for policy has one more hike to 5.5%. We must expect a 25bp move to 5.5% in May. Even if it is a step too far, it’s a step they are clearly willing to take (and they can mop up afterwards). We continue to highlight the risk of overtightening. The reality of which rises with every move.

Take the third-to-last paragraph out of the Meeting Minutes, and you’d think the RBNZ had delivered a 25bp hike, not 50bp. Demand and supply are still out of whack which warrants further tightening. But we’re in a much weaker environment. And the RBNZ knows it. “Overall, the Committee’s assessment is that the economy is starting from a slightly weaker position than assumed in the February Statement” (RBNZ April MPR). For one, December quarter economic growth was softer than forecast. The RBNZ had picked a 0.7% quarterly gain. Instead, economic activity contracted 0.6%. And the third quarter numbers were downwardly revised. Essentially, the second half of 2022 was not as strong as the RBNZ had envisaged. On top of that, both business and consumer confidence remain downbeat. Businesses aren’t willing to invest, and households are tightening their belts. It’s growing evidence that monetary policy is beginning to take effect, as intended. But the RBNZ wants to see more. And more importantly, the RBNZ wants to see this dampened demand manifested in lower inflation and reasonable price growth expectations. We’re yet to see this in the (lagging) official numbers. And until (core) inflation firmly turns south, and expectations are re-anchored, we can only expect more tightening from the RBNZ – as they’ve warned.

The RBNZ is justifiably determined to lower inflation, whatever the cost. And today’s supersized hike reflected the RBNZ’s resolve. Demand, they say, continues to outstrip supply, causing inflation.

Financial markets reacted immediately to the outsized surprise. Traders had factored in a 25bp hike to 5%. Although in the days/hours leading up to the decision, the April OIS had crept up to 5.03%. Some (clever) traders had taken a bet (risking 3bps to make 22bps) that the Shock and Orr nature of the RBNZ will deliver something larger. And that bet paid off, handsomely. Further out the curve, the 2-year swap rate jumped 13bps to 5.13%, and the curve flattened a few bps.

The Kiwi dollar did exactly as it was told. It jumped 50pts on the spot. At 63.56, the Kiwi has entered a bit of a slipstream higher. The RBNZ continues to stand tall when compared to their international peers. And the RBNZ’s actions continues to support the Kiwi higher.

RBA hits pause.

It’s a different story across the Tasman. After 10 straight rate increases, the RBA paused, and left the cash rate at 3.60%. Much lower than the RBNZ’s 5%. With the luxury of monthly data, there’s now firm evidence that inflation in Australia has turned the corner. Signs of weakening economic growth are also surfacing, with relatively modest household consumption. Both these developments afford the RBA with the option to pause and assess the 320bp of tightening delivered so far. And that is exactly what they are going to do: “The decision to hold interest rates steady this month provides the Board with more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty”. But the RBA isn’t calling quits just yet. They remain on high alert for any signs of a reacceleration in price pressures. And they stand at the ready to tighten again: “The Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target.”

The Bank of Canada has also paused tightening. So what do the BoC and RBA know that we don’t? Well they have more timely inflation data to start. The recent rates of inflation are a little lower in Canada and Australia. It’s helpful having monthly data. It’s more timely. We have to wait an economic eternity before we see the next read on price pressures. Nevertheless, we believe NZ’s current inflation print is lower than the last print of 7.2% – published for an outdated quarter to end last year. Inflation has peaked, globally, and the outlook is improving with central bank actions taking effect. Inflation was running higher in NZ, compared to Australia and Canada, prior to Covid. And the RBNZ is wary that we might still have higher inflation today. It’s only a matter of time until the RBNZ starts sipping the same Kool-Aid.

RBNZ Statement

“The Monetary Policy Committee today increased the Official Cash Rate (OCR) by 50 basis points, from 4.75 percent to 5.25 percent.

The Committee agreed the OCR needs to increase, as previously indicated, to return inflation to the 1-3 percent target range over the medium term. Inflation is still too high and persistent, and employment is beyond its maximum sustainable level.

The level of economic activity over the December quarter was lower than anticipated in our February Monetary Policy Statement and there are emerging signs of capacity pressures in the economy easing. However, demand continues to significantly outpace the economy’s supply capacity, thereby maintaining pressure on annual inflation.

The recent severe weather events in the North Island have led to higher prices for some goods and services. This higher near-term CPI inflation increases the risk that inflation expectations persist above our target range.

Over the medium term, the Committee anticipates economic activity to be supported by rebuilding efforts in the aftermath of the weather events. The demand on resources is expected to add to inflation pressure by more than assumed in the February Monetary Policy Statement.

Global growth is expected to be below average, contributing to lower demand for New Zealand’s key commodity exports. Continued growth in New Zealand’s service exports, in particular tourism, is assumed to provide some offset to this drop in export revenue.

New Zealand’s economic growth is expected to slow through 2023, given the slowing global economy, reduced residential building activity, and the ongoing effects of the monetary policy tightening to date. This slowdown in spending growth is necessary to return inflation to target over the medium-term.

The Committee agreed that the OCR needs to be at a level that will reduce inflation and inflation expectations to within the target range over the medium term. The Committee agreed that maintaining the current level of lending rates for households and businesses is necessary to achieve this, along with a rise in deposit rates. New Zealand’s financial system is well positioned to manage through a period of slower economic activity.”