It’s all about inflation. And inflation is weakening.

6 November 2023 / 9 min readKiwibank economists, Jarrod Kerr, Mary Jo Vergara and Sabrina Delgado provide the latest insights on inflation.

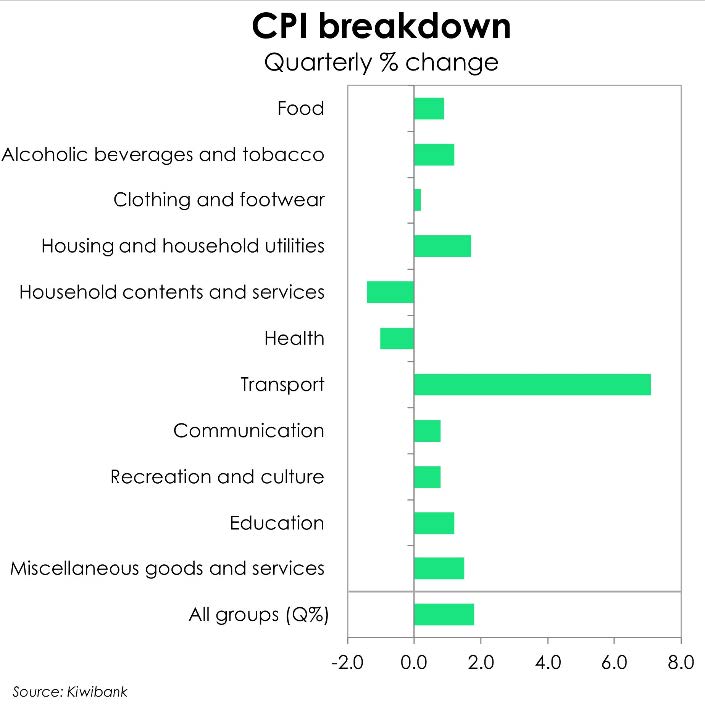

- Prices rose 1.8% over the September quarter. And petrol prices were to blame for the outsized move. Petrol was up 17% on the quarter, and the transport group surged 7%. We lost another battle with the inflation beast, over the quarter. But we are winning the war, over the year.

- The annual rate of inflation dropped from 6.0% to 5.6%, well below market consensus of 5.9%, and the RBNZ’s forecast of 6.1%. That’s a big psychological shift. Employers and employees, price makers and price takers, are adjusting from inflation running in the 7s, to 6, to now in the 5s. And we expect inflation to be in the 4s come year end. Price setting, especially wage setting, will be moderated in response. We’re heading in the right direction. And negotiations should be less heated.

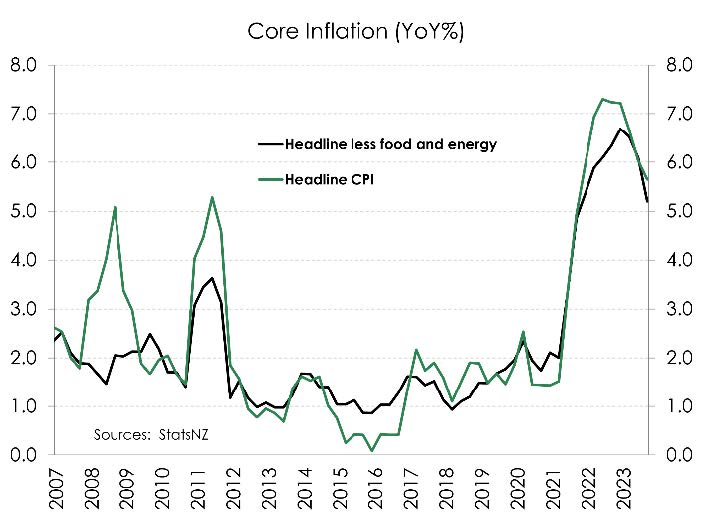

- When you slice and dice the data, you get some pleasant surprises. Imported inflation fell to just 4.7% over the year, well below forecast. And domestically generated inflation held at 6.3%. It didn’t lift. Core inflation, which strips out the stuff we don’t like, fell to 5.2% from 6.1%. That’s a big move. The whole Kiwibank trading floor had a collective sigh of relief on these numbers. Get down!

Over the quarter, we lost another battle with a persistent foe. The quarterly print of 1.8% is frustrating for households. But it could have been much worse. Oil prices have spiked, and that’s ‘fuelling’ transport costs. The fluctuation in oil prices came at the same time the Government reintroduced excise taxes. It was a large spike. It’s important to note that the spike in oil, and therefore petrol prices, act like a tax on consumers. When prices of essentials jump, spending on non-essential items fall. Consumers are forced to adjust. And consumers have been hit hard by surging inflation. Especially on essential items, and an aggressive lift in interest rates. We have seen this shift in our spending tracker. And within the CPI report, we saw prices on household contents falling. Because demand has fallen.

We are winning the war on inflation!

The annual rate of inflation fell from 6.0% to 5.6%. And that’s important. Inflation prints are deflating, as expected.

Inflation has eased from a peak of 7.3% last year, to 5.6% today. That’s a big psychological shift. Employers and employees, price makers and price takers, are adjusting from inflation running in the 7s, to 6, to now in the 5s. And we expect inflation to be in the 4s come year end. Price setting, especially wage setting, will be moderated in response. We’re heading in the right direction. And negotiations should become less heated.

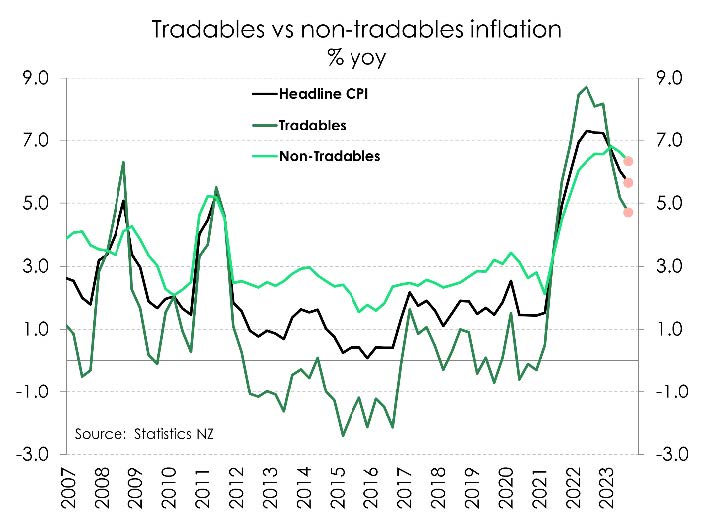

Imported inflation continues to move, rapidly, lower. Tradables inflation has fallen to 4.7%yoy, from 5.2% and a far cry from the 8.7% peak. The material fall in imported inflation is helping to drag the headline rate lower. Domestic inflation is also cooling, albeit more gradually. Non-tradables decelerated to 6.3% from 6.6%. With each update, it is becoming clear that domestic inflation has also peaked. A softening in services inflation is helping. Since 2020, services prices had been steadily rising as demand rotated away from goods and back toward services. And for the last three quarters, services inflation has been stuck in the low 6%s, the high-tide mark. Today’s update showed services inflation is letting up, easing back to 5.6% (from 6.1% last quarter). A softening in services is good news for the domestic inflation outlook.

We are wary that the move from +7% to 4% may be much easier than the next step. The required move from 4% to 2% may prove to be much more difficult. But it can be done.

We believe today’s numbers significantly reduce the likelihood of any further hikes from the RBNZ.

Whatever probability there was before today’s numbers, it’s closer to zero now. The rates market had the probability of an RBNZ rate hike in November at 50% (12/25), leading into today’s report. The terminal rate implied in the wholesale market was 5.72% – so nearly a full 25bp hike priced by April next year. After the release, the November pricing fell to 25% (6/25). And the terminal rate dropped to 5.63%. We should see a further reduction in rate hike expectations. We continue to call the peak in the cash rate at the current 5.5%. And we go one step further in suggesting rate cuts may become likely by May next year.

Broad-based gains are breaking down

Price gains continue to be broad-based, but are becoming less so. Of all items within the basket, 58% recorded a rise in prices – still a majority, but a shrinking one. Last quarter, 68% of all items increased in price. In addition, more items recorded a decline in prices (from 21% to 29%). So we are getting some deflation in the mix. Overall, an easing in consumer price inflation remains the underlying theme.

Driving the rise in quarterly inflation was the 17% rise in petrol prices over the quarter alone. Since June, global oil prices have been trending higher – up over 30%. At the same time, the 25c fuel excise duty tax was re-applied in July. Prices at the pump have moved higher. And the overall transport group recorded a gain close to 8% – the biggest quarterly rise since 1991. However, it’s a smaller gain than otherwise. Because the weight assigned to petrol was recently revised down, from 4.9% to 3.9%. So the recent rise in petrol contributed a smaller amount to the headline print.

Providing some offset to the rise in petrol was the material softening in food prices. Global commodity prices have eased and it’s flowed through to a moderation in domestic food price inflation. Food prices lifted just 0.9% over the quarter and 8.8% over the year. It appears food inflation has (finally) peaked. Adverse weather conditions earlier this year resulted in double digit increases in prices for food, especially fresh produce. But prices appear to be normalising. Compared to a year ago, fruit and vegetable prices are up 4.4% , down from ~20%. Stats NZ also increased the weight assigned to food by 0.8%pts. The softening in food prices has had a greater influence on the headline outcome.

While the price impact of the Cyclone and weather events on food prices has normalised, the impact on insurance continues. Insurance premiums accelerated over the quarter. Home insurance and contents insurance rose 5.6% and 6.6%, respectively. Higher risk areas were hit harder, with even higher premiums. We expect to see this re-pricing of insurance (esp. in high risk areas) continue, and become even more targeted. Some houses may become uninsurable. That’s a discussion for another day. But it’s inflationary and will remove housing stock.

A significant slowing in annual housing inflation was also evident in today’s report. Helped primarily by cooling construction costs, housing inflation decelerated from 7%yoy to 5,3%. Home construction costs rose just 0.6% over the quarter, down from Q2’s 1.1% rise. While cost pressures remain strong, they are clearly easing. Annually, construction costs have plunged to 5% from the 18% peak recorded late in 2021.

Over the quarter, however, housing inflation did accelerate to 1.7% from 1.2% largely due to two drivers: Firstly, the usual movement in property rates during this time of year. And this year, the rise in council rates was especially strong, up 9.8% over the quarter. A chunky gain was to be expected. Rates increases this year have been steep, with some regions experiencing an over 10% rise. The second driver was the acceleration in rental inflation. Over the quarter, rents jumped 1.2% (up from 1.1%). No doubt the surge in migration is putting upward pressure on rents. And for the past four quarters, rent prices have been creeping higher. Annual rents are up 0.2%pts to 4.4%

Cost pressures faced by firms continue to ease. And consumer demand is weakening. The end result is a weakening in price gains. The September quarter saw just a 0.2% rise in clothing and footwear. And prices for household contents and furnishings actually declined 1.4% over the quarter. We’ve long flagged the downside risk to demand for consumer goods and thus the deflationary potential. As we’ve seen in our data, demand has fizzled. And today’s report showed that the price is starting to respond.

Underlying price pressures are easing

The fall in core inflation is the cherry on top for the RBNZ. Annual core measures of inflation – stripping out the volatile food and energy prices – have dropped nearly a whole percentage point from 6.1% in June to now 5.2%. Although still an elevated rate, it’s a huge positive shift lower. Core inflation is well below it’s 6.7% peak in December. Trimmed-mean measures of inflation (excluding volatile price movements) also eased to 5.6% from 6.0% in June. Overall, an easing in both of these data points shows a softening in the underlying inflation trend. Inflation is well past its peak and is falling at considerable pace.

A dampener, however was the acceleration in core inflation on a quarterly basis. Over the quarter, core inflation jumped from 0.9% to 1.3% The shift lower in the annual rate is encouraging. But the quarterly lift may slow the deceleration. Watch this space.

No more rate hikes are needed

Inflation is moving in the right direction. By the December quarter, we see headline inflation decelerating to around 4%. Favourable base effects are in play with last year’s spike in energy and food prices falling out of annual calculations. Cooling commodity prices will also help to lower the cost of imports. And a stalling post-Covid recovery in China will also weigh on imported inflation. Inflation in China is currently just 0%, having fallen from 2.8% last year. So we’re unlikely to import a lot of inflation from our largest trading partner.

Here in Aotearoa, the tricky task is getting back to the RBNZ’s 2% target. A task that hinges on the projected path for domestic inflation – the stickier, demand-driven kind. And a task made difficult by the ongoing strength in wage growth.

We expect the RBNZ to sit tight for the remainder of the year. The RBNZ signalled 5.5% as the peak in the cash rate, with a “very, very high bar” for further increases. We expect no more. The data to date has been weak. And the data to come will also be weak. Signs of an imminent slowdown in economic growth are already surfacing. Firms are pessimistic about future trading activity and households are pulling back on discretionary spending. The RBNZ will also take comfort in today’s report confirming that inflation is on the way down. There’s no need to tighten further. Monetary policy operates with long lags, and we’re yet to see the full impact of past actions on today’s economy.