Commercial Property Market Analysis

31 January 2024 / 5 min readby CBRE Head of Research, Zoltan Moricz

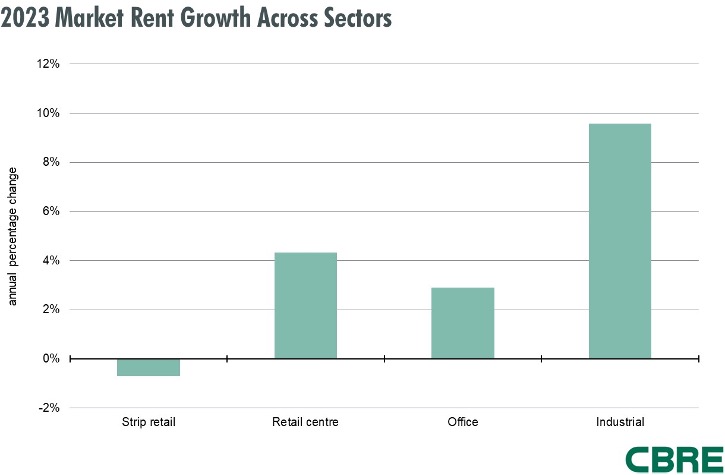

The economy cooled during 2023, but commercial and industrial property occupier markets remained resilient as the inflation hedging nature of real estate rents manifested itself in sectors with favourable supply-demand dynamics. Following strong growth in 2022, industrial market rents increased by 10% in the past year. This growth reflected the continuation of historically low vacancy levels and high development costs, which exerted pressure on new built rents that have percolated through the broader market.

While less dramatic, rent growth was also positive in office and retail although patchier across these markets. Occupiers’ desire for high-quality and well-located buildings has driven growth in prime office rents but this flight to quality trend had a negative impact on the secondary office market. Retail centre rents continued to benefit from the inflationary impacts of CPI based rent review mechanisms even as retail sales have softened. Growth has been especially strong in the Large Format retail category. On the other hand, strip retail rents continued to stagnate. Although tenant activity has been positive in prime strip retail locations, it has yet to translate to upward rental pressure.

Sale campaigns showed long, careful due diligence activity and a wide pricing gap between vendors and purchasers. This reflects that at one end of the spectrum the market is characterised by owners who continue to have a very firm view on pricing for their assets and are unlikely to come under pressure to divest. On a “willing vendor” basis, this maintains a relatively firm floor for cap rates. We are also aware that the cap rate views of many “willing purchasers” currently tend to be well above these. Recent months saw progress in the price discovery process, with more investment deals concluding or underway, some with reasonably clear market price indicators. On balance, these pointed to continued upward pressure on cap rates and lower sales prices.

However, in CBRE Research’s opinion, the rate of cap rate increases in the last two quarters were the smallest since the easing cycle commenced in early 2022, and we believe that the market is close to the top of the current cap rate cycle.

In 2024, restrictive monetary conditions will continue to hinder economic growth, and interest rate-sensitive pockets of the economy, such as residential investment, business investment, and household spending, are expected to underperform. Recent events have increasingly challenged the Reserve Bank’s narrative of higher for longer interest rates. The first event late last year was the release of the latest quarterly GDP result, which showed the economy is materially weaker than expected, compounded by downward revisions of growth rates earlier in the year. The second event was the US Federal Reserve’s dovish assessment of the inflation outlook and interest rates. The Fed expects to cut rates by 75 basis points by year-end 2024, which will lower interest rates globally.

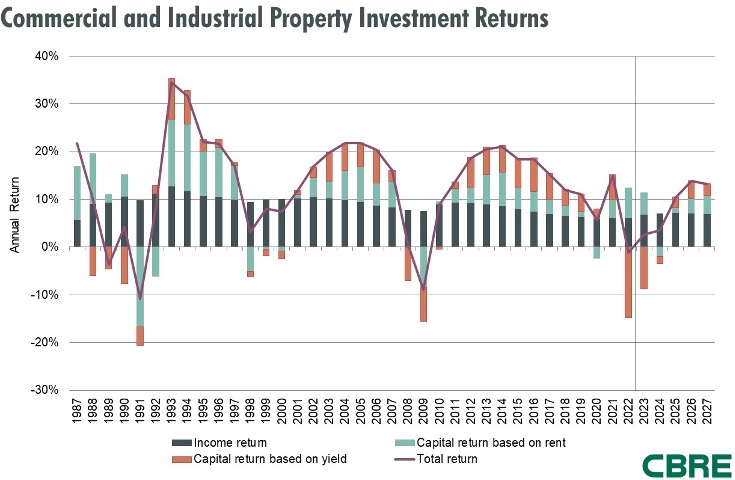

The combination of economic and interest rate conditions in 2024 will flip the trends we have seen during the past two years in the performance of commercial and industrial property markets. We expect the environment for occupancy and rents to become more challenging, but investment market dynamics to become more favourable.

With the gradual moderation of interest rates, we forecast that cap rates will remain largely flat in 2024 before improving in 2025. The economic slowdown and its impact on demand and vacancy will result in weaker rental growth in 2024, but with significant variation across sectors that will broadly reflect supply-demand and vacancy trends and lessor/lessee pricing power.

In 2024, the fortunes of the office and industrial markets will likely diverge for market rent growth, with some geographic distinctions also becoming evident. While the Auckland prime office markets will be relatively insulated from the impacts of new supply and are expected to benefit from ongoing occupier demand, Wellington office will be more exposed to rising vacancies. Auckland industrial will also be more exposed to increasing vacancies as demand moderates and a large supply pipeline is completed. We expect its strong rental performance of the past two years to dissipate in a more competitive leasing market in 2024. It is important to note though that many investments will still see growth in their rent roll through the rent review mechanism that, in 2024, will be capturing the market rent growth that occurred in the past two years. The retail sector will be insulated from new supply impacts, but retail sales will be weak, and this, combined with lower inflation, will result in lower turnover and rent growth than seen last year. We believe the large format retail sector will outperform malls and strip retail locations.

The following chart shows a synopsis of our income and capital return forecasts due to rent and cap rate changes and their impact on total returns. The lack of market rent growth in 2024 results in relatively modest total returns, but by 2025, both rents and cap rates will contribute positively to capital returns, and in 2025-2027, total returns are forecast to reach double digits. Average annual total returns to 2027 are forecast at 9.4%, of which capital returns contribute 2.1%.